Insights

The Net Zero numbers: offices.

Costing new buildings: part 1.

The UKGBC framework definition of Net Zero Carbon in 2019 was a key step on the journey to a net zero built environment, with recent studies highlighting that more sustainable buildings will command higher values and reduce costs in the long term.

But the design measures required and associated capital cost impacts have yet to be fully identified. To provide some answers to these questions, we took part in a recent study, coordinated by UKGBC, along with colleagues from across the industry;

“Building the Case for Net Zero: A feasibility study into the design, delivery and cost of new net zero carbon buildings” is based on two case study projects, a new commercial office building and a residential apartment block.

Office methodology.

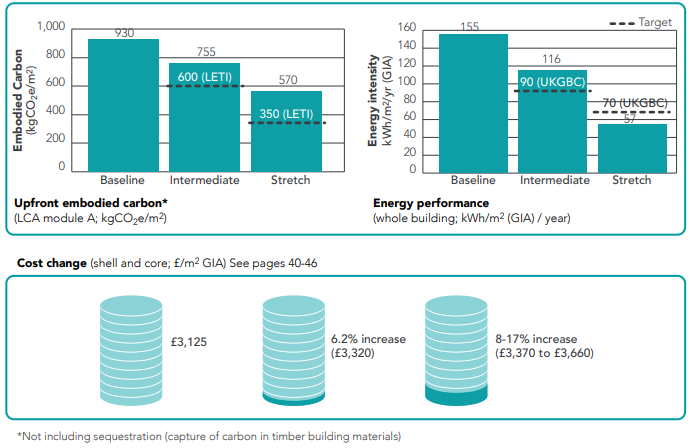

As a team, we identified the required design interventions needed to achieve Net Zero targets for both operational energy and embodied carbon. Two office scenarios were explored against a baseline design. The ‘intermediate’ scenario used net zero targets for 2025 to represent buildings that are in, or will soon be in, design, and a ‘stretch’ scenario uses targets for 2030 to represent design changes that will need to become the norm over the next decade.

The office baseline design represented the conventional design of high-rise office buildings and assumed:

– a steel framed superstructure with composite concrete floors on profiled metal decking, and floor-to-ceiling aluminium curtain walling.

– gas boiler and electric chiller, fan coil units and constant volume fresh air provided by centralised air handling plant (with heat recovery).

– a full suspended aluminium ceiling and raised access floor.

Intermediate design.

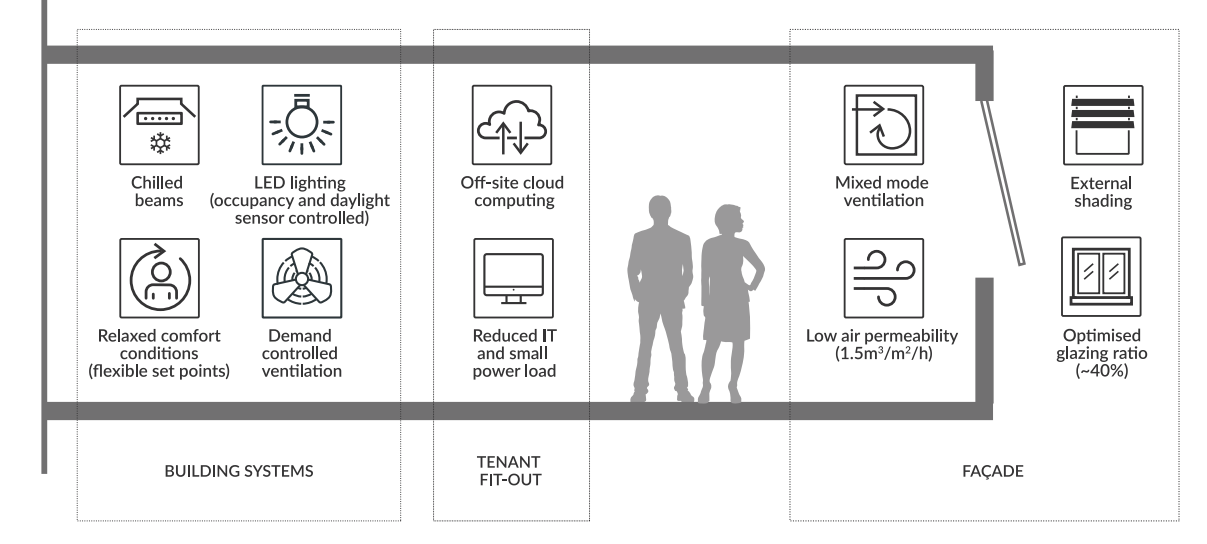

The office intermediate design retains the steel superstructure, but replaces the composite concrete floors with cross-laminated timber (CLT) panels, and incorporates orientation considerations into the facade, with lower glazing ratios of 60% to the east/west and 40% to the south. It features an all-electric plant solution utilising a (reversible) air source heat pump for heating and cooling, with active chilled beams and demand-controlled ventilation. The suspended ceilings are removed, and the raised access floors are recycled, all of which reduces the impact on embodied carbon.

The cost uplift for the intermediate office design was calculated as 6.2% compared to the baseline scenarios. However, it can be argued that this will be offset to some degree by value benefits, such as increased rental premiums, lower tenancy void periods, and lower operating/ lifecycle costs.

What about the stretch design?

The stretch design incorporates a full structural timber frame, with CLT floors supported on glue laminated timber (glulam) beams and columns. To achieve further carbon savings, the double height basement is removed, and the structure is founded on concrete pile caps and piles, with a suspended concrete slab forming the ground floor. The most significant change to the façade is the introduction of mixed-mode ventilation, with openings in the façade, and glazing ratios are further reduced to 40% all around the building. Off-site cloud computing is adopted by tenants and onsite server room usage is reduced. Less office lighting is needed thanks to a combination of background and task lighting, reduced lux levels, and emerging technologies. Finishes are further stripped back, moving from a recycled raised access floor to a simple floating timber build-up.

The cost uplift for the office stretch scenario was found to be between 8-17%. Accounting for timber sequestration, the design approach meets the demanding net zero targets for 2030, and cost estimates perhaps reflect the fact the marketplace is not yet fully geared up to deliver at scale.

An investment worth making.

Ultimately, the report shows how the transition to a net zero built environment is becoming achievable with effective design changes and adequate investment.

The tide is turning and it’s clear there are major rationale for absorbing these costs: whether that’s ESG drivers or investor pressure (such as the Task Force on Climate-related Financial Disclosure), alongside the ever-growing reputational, health & wellbeing, and operational cost benefits.