Insights

What can we take from COP29 into 2025?

What can we take from COP29 into 2025?

Now the dust has settled in Azerbaijan, it’s time to reflect on the lessons that we can take from COP29 into 2025. Whilst fewer people attended than COP28, it achieved some minor progress and lessons can be learnt in the run up to COP30, to be hosted by Brazil in November 2025.

I tracked the outcomes of the conference and spoke with others that went. This is what I have taken away from COP29 including key actions for our industry.

There is still hope.

Limiting global warming to 1.5-2.0 degrees is still physically possible.

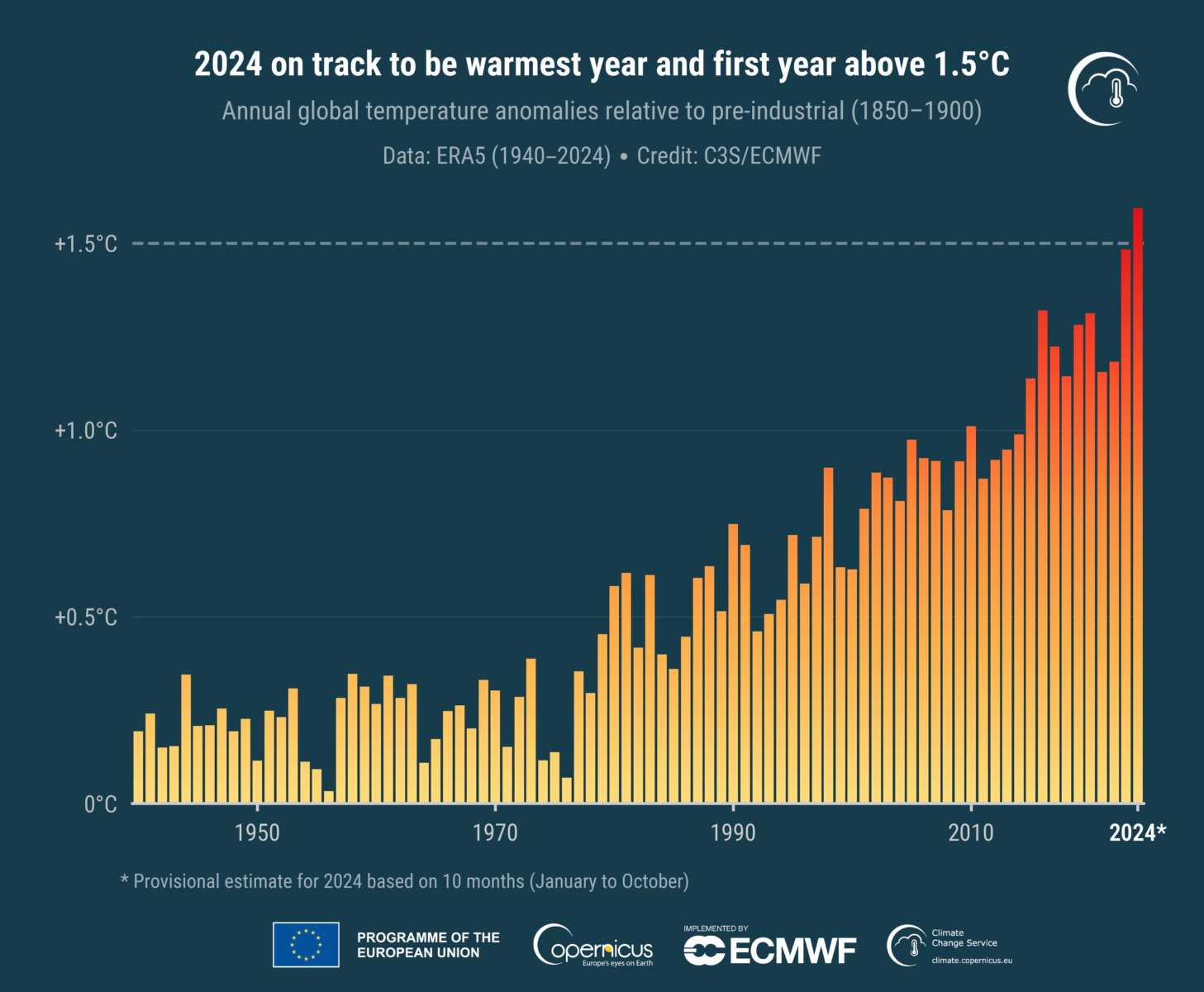

Whilst the world exceeded 1.5°C above pre-industrial levels for the first time in 2024, it doesn’t mean we have breached the Paris Protocol target yet. The Paris Agreement temperature goal is to limit human-made global warming to 2.0 degrees, and ideally 1.5 degrees, in the long term, averaged over 20 years– in other words, exceeding 1.5 for one or two years could still mean we don’t go beyond this over the longer term, although we will need to half emissions by 2030.

Image: Copernicus Climate Change Service/ECMWF

Leadership matters!

We shouldn’t underestimate the value of the UK’s leadership in climate policy and what this demonstrates to other countries. The UK was one of the few countries to declare, ahead of schedule, the nation’s updated pathway for greenhouse gas emission reductions to 2050. This has impressed many other countries, and it shows that taking leadership gets noticed. I attended the COP29 Outcomes Forum at Kings College London recently where the Ambassador from Azerbaijan and a European diplomat both said that UK’s climate leadership is appreciated, respected and encourages others to step up their efforts.

Rich countries could do more to support vulnerable countries.

Climate finance was a central theme at COP29. The developed nations agreed to commit $300 billion annually by 2035 for ‘loss and damage’ funding to help developing nations cope with the worst effects of climate change. Many vulnerable nations and global experts say that this needs to be several times higher than this, and even if the $1.3 trillion that is requested is raised, it will still be less than 1% of global GDP. We are expected to see continued climate damage to low-income countries in 2025, and more support from countries that have significantly contributed to global warming is needed for those that didn’t cause the problem. And yet, smaller amounts of money can have a big impact in developing countries. On a smaller scale we invest in a carbon offsetting project in Panama where our money can do more.

The industry must act.

So, what can we, working in the built environment do?

Talk to the money people. The finance sector still needs to improve its evaluation of investment impacts.

I’ve heard several finance experts declare that investors have made good progress in recognising the need for setting ESG criteria in their investments, but more needs to be done to evaluate outcomes. At the moment investors are relying on ESG fund project managers to consider how the money is invested but with little feedback or checking that the intended carbon reduction outcomes have been delivered. As a consultancy we still notice that it’s rare for lenders to want performance evidence to validate that goals have been met, and yet we can provide this, along with early advice that could shape investment. This needs to change in 2025.

Act more on future resilience needs.

Climate resilience and adaptation, whilst increasingly getting agenda time at successive COP conferences, are still inadequately addressed in the climate agreements signed at the end of the conferences. One investor admitted that over 95% of climate related funds focus on carbon reduction without requirements for demonstrating climate resilience. This means we aren’t sufficiently ensuring that regeneration projects and new developments will be resilient to warming and flooding, which will lead to harming more people’s lives, homes and sources of income, as well as increased costs for repair later. The industry needs to collaborate with investors to better understand climate risks and how to mitigate them.

As we near the 10-year anniversary of the Paris Agreement, key initiatives launched then are now under pressure. Despite this, we have made good progress as an industry in understanding our impact, but now we must collaborate with financiers, and insurers to drive more meaningful action.