Insights

How will it work in workplace? Retro-Fit for the future: pt 1.

Thinking from our retrofit-roundtable event.

It’s a well cited statistic in the built environment that 80% of our existing building stock will still exist in 2050. It’s also been postured that approximately 2 million of these buildings are in the non-domestic sector, so it stands to reason a significant proportion of these will be workplace buildings.

Our event brought together experts from across development, investment, architecture, and project management, making an eclectic mix that sparked a well-rounded lively discussion. The debates were centred around three retrofit topics specific to workplace: the economic imperative, the role of social value, and the factors for success.

In this two-part insight, the event hosts Amy Punter, Frances Brown, Diana SanchezBarajas & Dr Paul Hanna share the opinions and questions that arose during discussions:

1. Can we afford not to retrofit?

There is significant pace gathering across the built environment industry in relation to the need to retrofit our existing building stock and decarbonise accordingly. The carbon imperative is on many radars, as are the changes to minimum Government requirements (e.g., minimum EPC rating B in tenanted buildings by 2030, which of course will require action asap to address in time). However, perhaps less discussed are the financial and social drivers for retrofit.

We are seeing an increasing number of building owners looking at means to mitigate the risk of their assets becoming stranded.

This is often driven by the need to meet the anticipated minimum government and carbon agenda requirements and a concern over the financial implications of adhering to these, however pressure is also arising in another direction; Economic Social Governance (ESG). As we see a shift in investors pricing climate risk into the value of assets, this moves building owners not just from a position of their building not performing in line with carbon agenda targets but losing value to the point of becoming a stranded asset.

All about people-appeal

Whilst ESG is driving a shift top-down, we’re seeing a bottom-up shift with office occupiers becoming more discerning about their workplace choices. The rift between poor quality office space at low rents and high-quality office space in high demand will likely expand, as the low rents will have less appeal than pre-pandemic – people just won’t use these spaces. So, there is a need to keep all buildings performing at their best for the people within as well as for the planet.

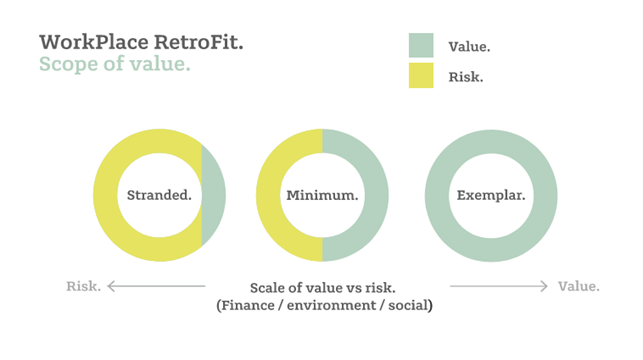

However, it doesn’t have to be all doom and gloom – where there is risk, there is also opportunity. There is risk associated with assets not meeting requirements in relation to the bear minimum; however, if we look beyond this, there is substantial opportunity to be gained by adding value to assets by maximising and broadening the scope of any retrofit works, i.e. broadening the brief to include environmental performance, as a means to add financial value.

Aside from the environmental benefits, re-purposing reinvigorates the local community and increases the financial value of that site. The added benefit? It attracts investment to the area thus creating a multiplier effect.

The regeneration and retrofitting of buildings around King’s Cross has created strong community benefits.

This kind of social value benefit is discussed in part 2 here, along with the creative approaches needed for retrofitting successfully.